There are two aspects to Morningstar's rating system. The first one is their star system. This one is based on past performance for active managers. The second one is an analyst forecast for the future.

The first aspect definitely deserves zero stars, and here is why.

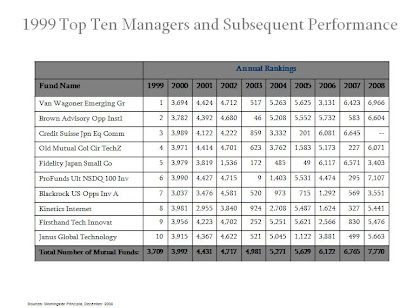

(Click to Enlarge)

This shows that after an actively managed fund reaches the pinnacle of performance it usually does not do so again.

The same is true for fixed income. So, the five star rating is definitely misleading for investors who invest using these generally high-cost funds.(Click to Enlarge)

Our second aspect of the Morningstar rating system is also flawed, but for a different reason. It has been found, that neither individuals that do it themselves nor analysts at institutions can consistently outperform the market by forecasting the future. This is not surprising, however, here is the evidence.

(Click to Enlarge)

Even Morningstar's Director of Research, John Rekenthaler says, "We should have more answers. There is suprisingly little that we can say for sure about how to find top-notch stock funds." And, commenting on whether investors should pay attention to mutual fund advertisements he stated, "...to be fair, I don't think that you'd want to pay much attention to Morningstar's rating system either."

No comments:

Post a Comment